When determining under which flag administration a vessel is to be registered, fiscal considerations will surely be of crucial importance.

European Union Member States took various measures in order to sustain the competitiveness of EU flag states

One of the measures taken by the Member states was to replace the traditional method of taxing the income of shipping companies and introduce a system of taxation based on the tonnage of the vessel, or fleet of vessels belonging to the shipping company, referred to as the Tonnage Tax. This system of taxation has benefitted international shipping companies operating cargo and passenger ships.

On the 17th December 2017, the European Commission conditionally approved the Maltese Tonnage Tax Regulations for a period of ten years. This decision was introduced by the Maltese Government through transposition into the Maltese legislation by means of amendments to Legal Notices 127 and 128 of 2018.

The Maltese Tonnage Tax Regulations provide that all ships falling within the scope of the regulations will be liable to pay a tonnage tax whilst being eligible for exemptions from other tax regimes, and shall be exempt from income tax in Malta. This comes about by virtue of the Merchant Shipping (Taxation and Other Matters relating to Shipping Organizations) Regulations, as amended in 2018, which exempts from income tax any income derived from shipping activities. In fact, regulation 5 of the said Regulations stipulates that:

“No further tax under the Income Tax Act shall be charged or payable on the income of that shipping organization, to the extent that such income is derived from shipping activities”.

Instead of income tax, Maltese law requires the payment of an annual tonnage tax by all Malta-registered vessels.

In order to apply for this scheme, the shipping company concerned has to be registered in the Malta Business Registry, including the name and tonnage of the vessel owned and being operated. The vessel has to be declared as being a Tonnage Tax ship to be owned, managed, operated, or chartered, etc. by the shipping company concerned.

The minimum tonnage for a vessel to be accepted as a Tonnage Tax ship is 1,000 gross tons.

The tonnage tax is paid annually with the vessel registration fee, and both are paid to Transport Malta. Upon payment of the tonnage tax and registration fee, an annual Certificate of Registration is issued for the vessel in question, and the Certificate shall remain valid for a full year from the date of its issue.

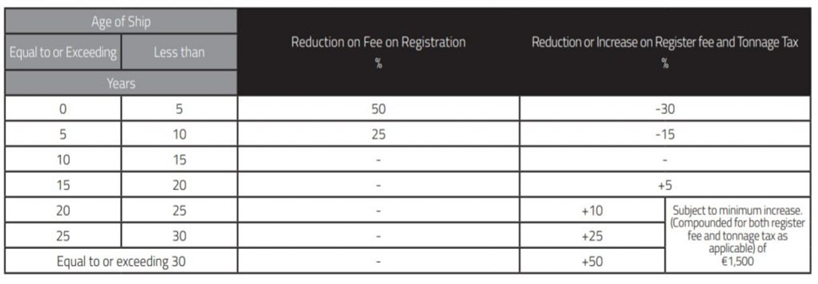

The rate of tonnage tax reduces according to the age of the vessel.

Ship management activities are also included in the tonnage tax system. This means that ship managers are allowed to pay a tonnage tax which is equivalent to a percentage of the tonnage tax paid by the owners and/or charterers of the ships managed. Any income derived by a ship manager from ship management activities is deemed to be income derived from shipping activities and is therefore exempt from income tax.

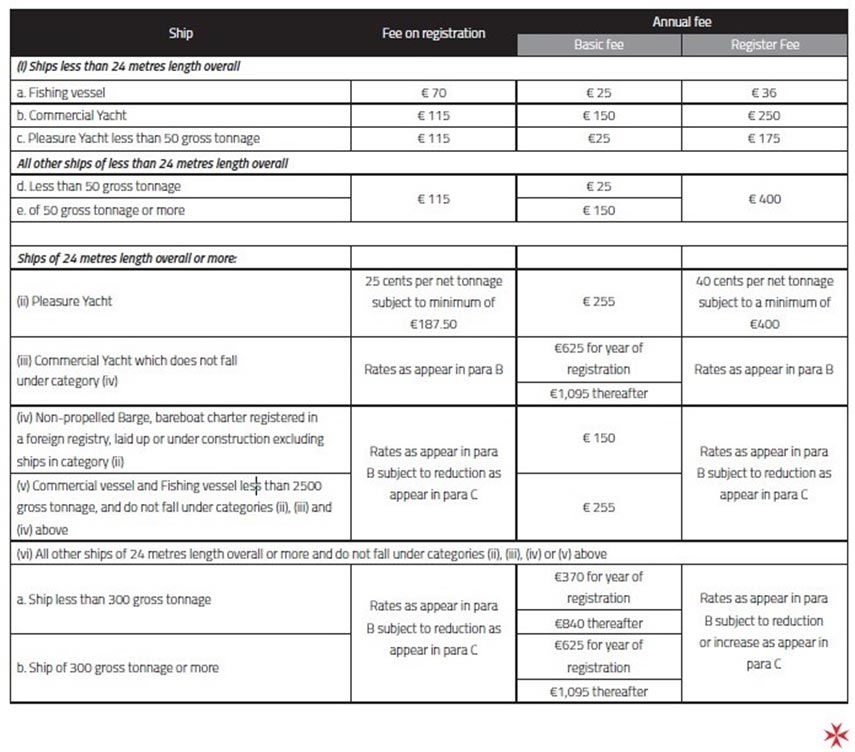

Schedule of Fees

Registration fees and tonnage tax.

Ai. The fee on registration and the annual fee for non-tonnage tax ships.

Aii. The fee on registration and the annual fee for tonnage tax ships.

Aii. The fee on registration and the annual fee for tonnage tax ships.

Subject to the provisions of article 7(4) of this Act, when there is a change in the particulars or category of a registered ship and the new applicable fee or tonnage tax payable on registration or annually is higher than that already payable, the provisions of article 19(7) of this Act in respect of laid up vessels shall mutatis mutandis apply.

Subject to the provisions of article 7(4) of this Act, when there is a change in the particulars or category of a registered ship and the new applicable fee or tonnage tax payable on registration or annually is higher than that already payable, the provisions of article 19(7) of this Act in respect of laid up vessels shall mutatis mutandis apply.

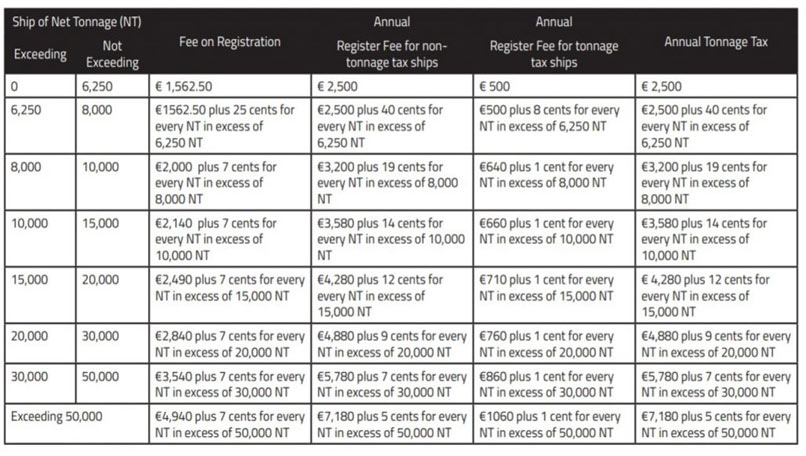

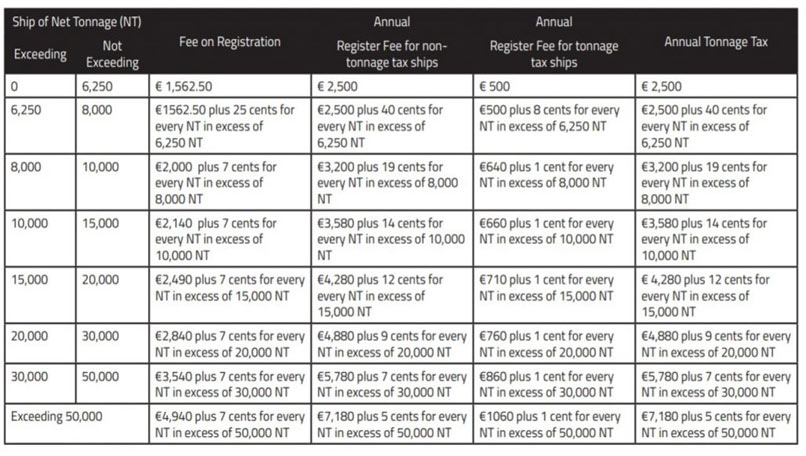

B .The rates per net tonnage payable on registration, annual registration fee and annual tonnage tax when referred to in paragraphs A.i and A.ii.

C. Reduction or increase on the rates per net tonnage on registration, registration fee and tonnage tax, when referred to in paragraph A.i or A.ii.

C. Reduction or increase on the rates per net tonnage on registration, registration fee and tonnage tax, when referred to in paragraph A.i or A.ii.

Annual fees for any one year paid after the anniversary of registration for that year shall be increased by ten per cent. Pre-registration inspections are subject to a charge provided for in Merchant Shipping Notice 127 Rev 1.

The unit of currency is the Euro.

Therefore, to summarize and conclude, income from shipping activities in Malta is taxed as follows:

- Income derived from shipping activities by a licensed shipping organization is exempt from income tax, but subject to the Tonnage Tax as described above.

- Income derived from ship management activities by a ship manager is exempt from income tax, but subject to the Tonnage Tax as described above.

In all other circumstances:

- As regards shipping companies incorporated in Malta, these shall be taxed on their worldwide income and capital gains.

- As regards shipping companies not incorporated in Malta, but whose management and control is being from Malta, these shall be taxed on their local income and capital gains and on any foreign income which is remitted to Malta.

- As regards shipping companies which are not incorporated in Malta, and whose management and control are not exercised from Malta, these shall be taxed on the income and capital gains that arise in Malta.

Consult trusted accountants in Malta about your company tax rate; call Borg Galea & Associates at + 356 27037012.